From the United States to Romania: Opportunities and Challenges in Logistics Services During the Cross-Border E-Commerce Transformation

I. Turbulence in the U.S. Market: Tariff Policies Forcing Strategic Shifts Among Cross-Border Merchants

In April 2025, the U.S. government announced the imposition of “benchmark tariffs + reciprocal tariffs” on global goods, directly impacting the cross-border e-commerce industry. Take fast-fashion platforms SHEIN and Temu as examples: after the implementation of steel and aluminum tariffs, SHEIN’s sales plummeted by 16%-41% within five days, while Temu saw an even steeper decline of 32%. With intensified trade barriers, Chinese sellers urgently need to seek emerging markets with friendly policies and convenient logistics—and Romania has become a key breakthrough.

II. Romanian Market: The Gateway to the EU and a New Blue Ocean for Logistics Services

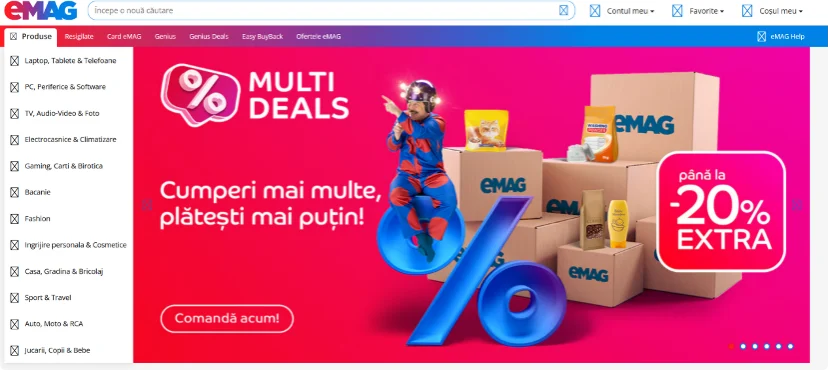

As an EU member state and a country along the “Belt and Road” initiative, Romania boasts unique geographical advantages: by registering a local company, goods can enter the 27 EU countries tariff-free, covering 450 million consumers. Additionally, the country has a weak manufacturing sector and strong import demand, with 55% of internet users (approximately 10.48 million people) accustomed to online shopping. eMAG, the largest local e-commerce platform (with 150 million monthly visits), is attracting Chinese sellers through four major policies:

- Service Upgrades: Establishing China-Romania tripartite teams (local + Shenzhen + Hangzhou), planning to set up offices in key cross-border e-commerce hubs to enhance store-opening efficiency;

- Operational Empowerment: Providing full-process support including advertising optimization, product selection analysis, and campaign planning to boost sales;

- Logistics Innovation: Improving the FBE warehousing network, offering storage fee reductions and other benefits for new sellers during peak seasons, and partnering with professional logistics providers to enhance fulfillment efficiency;

- Lowered Thresholds: Removing platform experience requirements and offering tiered fee discounts for high-unit-price categories.

III. Logistics Services: The Core Competitiveness in Cross-Border Transformation

In expanding into the Romanian market, logistics services have become a make-or-break factor. Meest China, a professional logistics provider, has launched the “Romania Special Line Logistics” to deeply address eMAG’s FBE first-mile needs:

- Multimodal Transport: Integrating air and land transport resources to provide flexible timing options and ensure rapid warehouse delivery;

- Warehousing Synergy: Seamless integration with eMAG warehouses to optimize the warehousing process and shorten order processing cycles;

- Compliance Assurance: Offering tariff declaration, compliance consulting, and other services to help sellers avoid policy risks;

- Data Support: Analyzing market trends to assist sellers in formulating inventory strategies and reducing logistics costs.

IV. Cases and Trends: Logistics Services Driving Market Growth

Currently, Chinese sellers account for less than 10% of eMAG’s user base, but categories such as 3C and home furnishings have shown explosive potential. For example, a 3C seller reduced first-mile delivery time from 45 days to 15 days through Meest China’s special line logistics and achieved first-month sales of over €500,000 with eMAG’s advertising support. As eMAG invests €100 million to support Chinese sellers, the importance of logistics services will further increase—efficient fulfillment capabilities are not only a supply chain guarantee but also a key endorsement of brand trust.

V. Seizing EU Opportunities: Logistics Services as a Precursor

The transition from the U.S. to Romania in cross-border e-commerce is essentially a dual game of “policy dividends + logistics efficiency.” For Chinese sellers, leveraging eMAG’s platform advantages and Meest China’s professional logistics services can both circumvent trade barriers and use the EU as a springboard to radiate into Eastern European markets. In this global layout, proactively building a dual-drive capability of “logistics + operations” will become the core code for seizing emerging market opportunities.