2025 Mexico Hot Sale E-commerce Promotion: Meest Mexico’s Dedicated Logistics Company Helps Chinese Brands Set Records

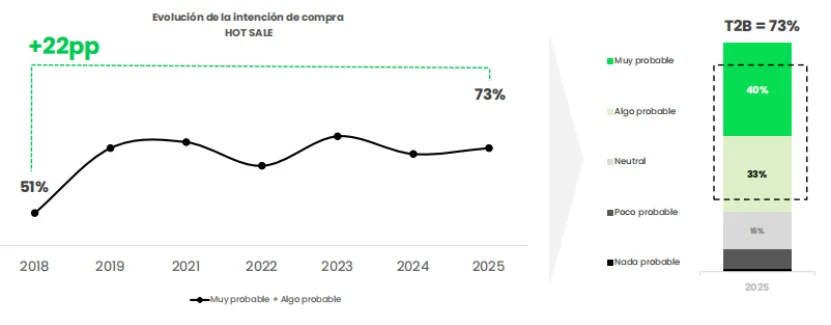

From May 26 to June 3, 2025, Mexico’s annual e-commerce event, Hot Sale, once again set off a shopping spree. According to data from the Mexican Association of Online Sales (AMVO), user participation reached a record high this year, continuing the growth trend of a cumulative increase of 22 percentage points in purchase intention over the past seven sessions. In this carnival, Meest Mexico’s dedicated logistics company provided key support for Chinese brands to break through the Mexican market with professional cross-border logistics solutions.

Sales Data and Consumption Trends

The 2025 Hot Sale continued to be popular. Although the final data has not been fully released, participation has set a new record. Discounts remain the core driving force, with over 60% of consumers deciding to purchase based on the intensity of discounts. The combination of “direct discounts + bank promotions” has lowered the consumption threshold. Payment methods are diversified, with credit cards taking the lead with a 55% share. OXXO Pay cash payments and the government-promoted CoDi digital payment are growing rapidly. Digital wallet payments account for 30%, and merchants using CoDi save up to 84,000 pesos in transaction fees annually.

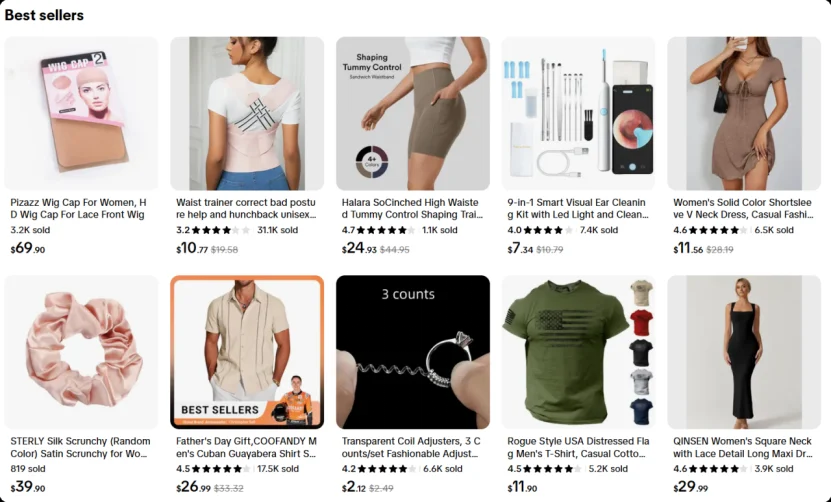

Three Major Categories Lead the Market

- High-frequency and just-needed categories: Supermarkets (food, daily necessities) and fashion (clothing, footwear) remain at the top of transaction volume. The fashion category has been the most popular for two consecutive years, with online purchases reaching 40% and 35% in 2023-2024 respectively. AliExpress’s fashion category sales increased three times year-on-year, and Mercado Libre increased the sales of this category by 44% with “exclusive discounts + same-day delivery”.

- Emerging technology categories: Consumer electronics and smart home appliances have become dark horses. In 2024, sales of mobile phones and accessories increased 20 times year-on-year, and niche categories such as electric guitars surged 30 times. New energy equipment is expected to account for more than 15%, and the growth rate of TikTok Shop’s fully managed 3C home appliance category exceeded 50%, with handheld game consoles ranking among the top 10 in GMV.

- Health and personal care categories: Segments such as hair care and tattoo tools have grown by more than 50%. 35% of consumers prefer products with natural ingredients and environmentally friendly packaging. This category has remained among the top three purchase categories in the past three years, with an average share of 21%-23%.

- Distinctive Characteristics of Consumer Groups

- Millennial men dominate: 60% of active shoppers are men aged 25-44, who prefer cost-effective technology products and sports equipment, driving the proportion of consumer electronics categories to 28%. In 2024, Mercado Libre’s e-sports co-branded mice sold over 5,000 units in the first hour.

- The rise of the silver-haired generation: Users over 55 years old account for 11%, an increase of 4 percentage points compared with 2020. They prefer practical products such as health monitoring equipment and cash-on-delivery services. 70% of users recognize the platform’s aging-friendly transformation.

The Breakthrough Path of Chinese Brands

- SHEIN: With “diversity and style expression” as the core, it invited local women as ambassadors, launched exclusive designs, offered discounts of up to 90%, and formed a grass-roots to conversion closed loop through social media operations.

- Dreame: Emphasizing 6,000 patented technologies, with a 43% discount plus 12 interest-free installments, it two major platforms online and set up experience booths offline to reach consumers through omni-channels.

- TikTok Shop fully managed: GMV exploded by 208%, with large clothing items taking the top 3 in hot sales, and 400,000 local influencers providing strong content support.

Meest Mexico’s dedicated logistics company ensures the fast and safe delivery of goods by optimizing logistics routes and improving delivery efficiency. Its professional team and rich experience have laid a solid foundation for Chinese brands to expand in the Mexican market. With the end of the promotion, Mexico’s e-commerce market is moving towards a new stage of experience upgrading and ecological construction. Meest Mexico’s dedicated logistics company will continue to help Chinese brands achieve new success.