How Logistics Services Respond to Price Increases: Challenges and Opportunities for Cross-Border E-Commerce

In today’s globalized business environment, the stability and cost-effectiveness of logistics services, as a bridge between production and consumption, are crucial to business operations. As the end of 2024, the logistics industry is witnessing a wave of price hikes, which poses many challenges for cross-border e-commerce companies and prompts them to re-examine their logistics strategies to adapt to market changes and capitalize on potential opportunities.

The current situation of the wave of price increases in logistics

International logistics giants such as UPS, FedEx and DHL have announced rate increases, with UPS leading the way in July 2024 with two increases in late September and mid-November for the peak holiday shopping season, and the holiday surcharge for 2024 reaching a record high in recent years. DHL has also issued differentiated rate increases for different regions. These increases cover a wide range of fee types, including surcharges, address correction fees, extended area surcharges, prohibited item fees, remote area surcharges and residential surcharges, as well as revisions to weight and dimensional calculations, demand surcharges and other related regulations.

Reasons behind the wave of price hikes

Cross-border e-commerce drives the growth of logistics demand: with the shift in overseas consumers’ shopping habits, China’s cross-border e-commerce platforms are rapidly emerging. The booming development of TEMU, the international version of Pinduoduo, the fast fashion platform SHEIN, Ali’s SMTP, TIKTOK and other platforms has pushed the volume of cross-border e-commerce logistics orders to grow geometrically. At present, China’s daily export of cross-border e-commerce parcels has exceeded 10,000 tons, and it mainly relies on air transport, which puts enormous pressure on logistics capacity.

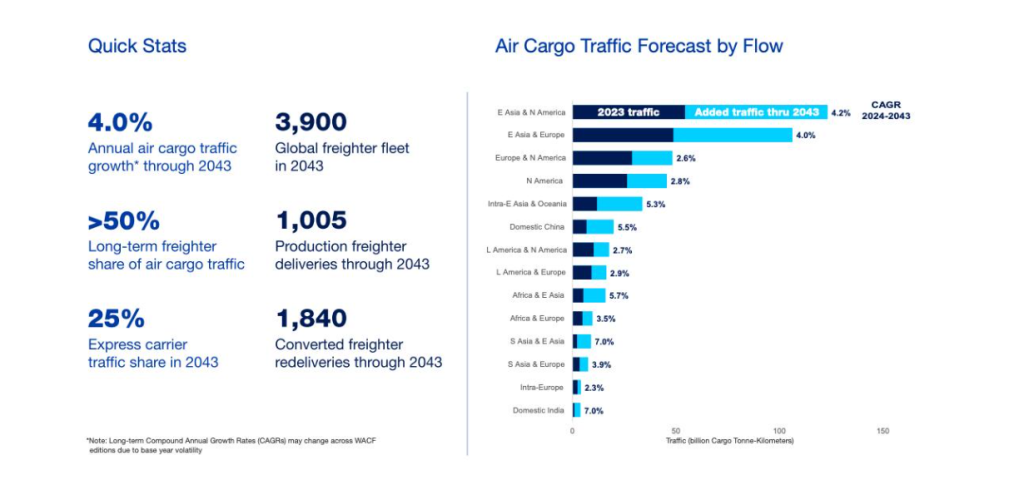

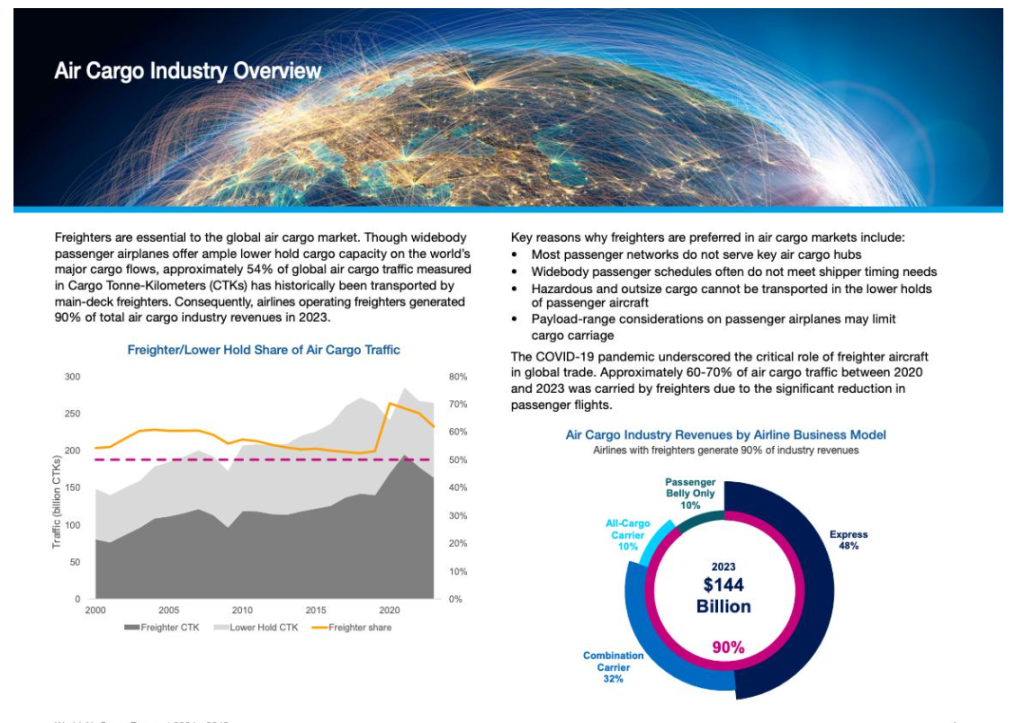

Imbalance between supply and demand in the air cargo market: Although the volume of cargo has exceeded the pre-epidemic level, the supply of capacity has not been able to keep up with the growth in demand. The limited number of all-cargo aircraft in China’s civil aviation industry, the insufficient number of long-range wide-body all-cargo aircraft in the world, and the lack of capacity in the belly compartments of passenger aircraft as a result of the slow resumption of international passenger routes have together led to capacity constraints in the air cargo market and price increases.

Challenges in the maritime market: Since May 2024, the maritime market has experienced severe space constraints, with a number of shipping lines running out of space and containers. Geopolitical factors, such as tensions in the Red Sea, have exacerbated the problem, and some routes have been rerouted, lengthening transportation distances and times and reducing the efficiency of container and vessel turnover.

Impact of emerging cross-border e-commerce operation modes: Taking the “semi-trusted” mode as an example, sellers have shipped their goods in advance to June and July to avoid high freight costs and tight space during the peak season at the end of the year, which has increased the pressure on sea transportation. Meanwhile, the prolonged ship cycle caused by route rerouting further aggravates the shortage of capacity.

Cross-border sellers’ coping strategies

Reasonable use of overseas warehouses: storing goods in advance in overseas warehouses in target markets can avoid logistics congestion during peak seasons and reduce distribution costs. Nearby distribution can shorten the logistics timeframe and save international logistics costs, while real-time inventory monitoring can help optimize inventory management and prevent out-of-stock or backlog.

Optimize the transportation scheme: according to the product characteristics and budget, choose the transportation mode flexibly, plan in advance for the peak season stocking and avoid the peak period. Evaluate the cost-benefit ratios of different transportation solutions and develop a logistics strategy that meets the actual situation of the enterprise.

Enhance product competitiveness: Optimize product structure and packaging design, improve unit transport value and enhance bargaining power. Develop high value-added products to better absorb rising logistics costs.

Diversified logistics channels: establish cooperative relationships with a number of logistics providers, comprehensively compare the cost-effectiveness of various programs, and reduce dependence on a single channel.

Development trends and opportunities in the logistics services industry

Although the wave of price hikes in logistics services has brought challenges to cross-border e-commerce, it has also accelerated the industry’s survival of the fittest. Enterprises should focus on the long term and optimize their operations while continuously improving their core competitiveness to seize new opportunities amidst market changes. Logistics service providers should also strengthen cooperation and innovation to improve service quality and efficiency to cope with market changes.

In short, the year-end price increase wave of logistics services is an important challenge facing cross-border e-commerce, but through reasonable planning and strategic adjustments, enterprises can realize their own development and enhancement in the process of coping with the challenges, and the logistics service industry will also continue to evolve and improve in the market changes.